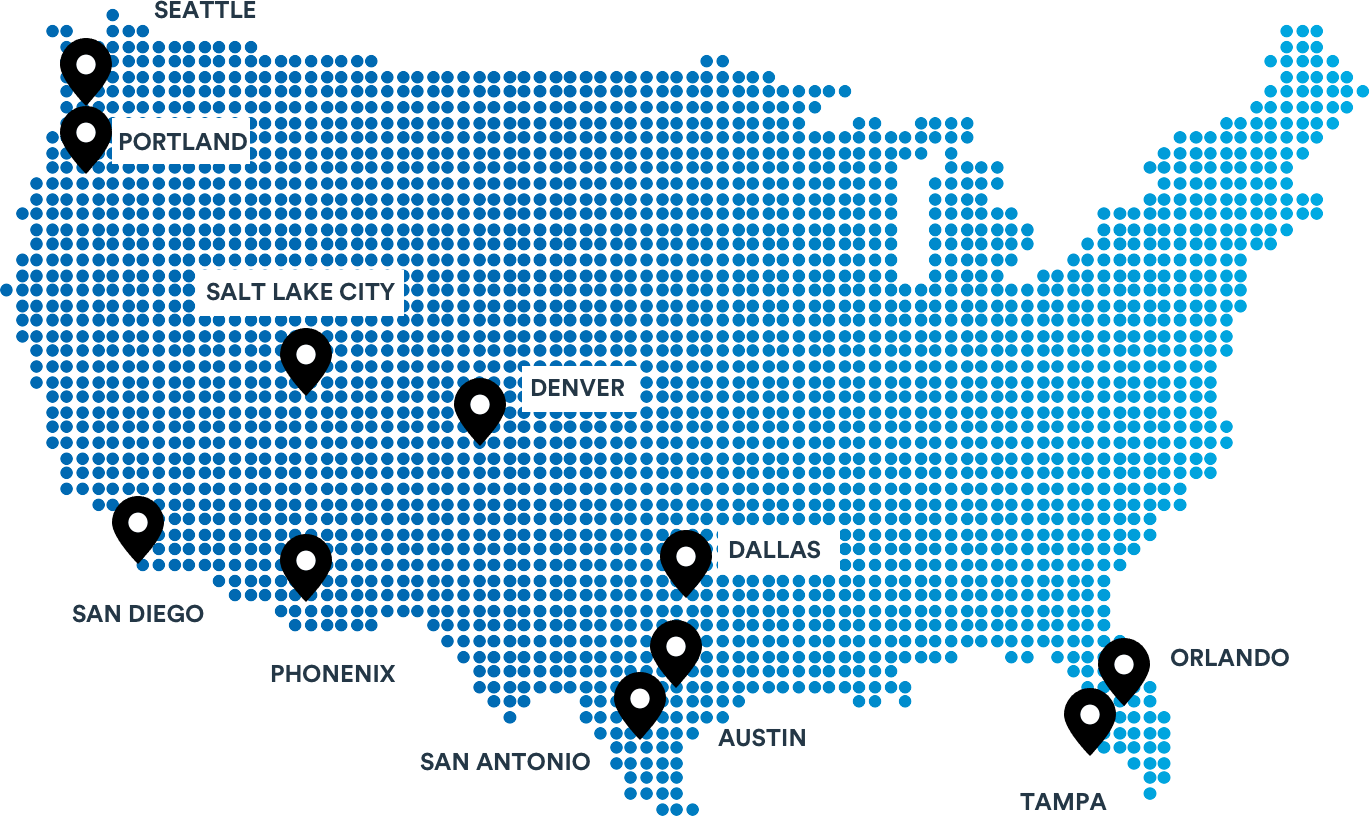

18 HOUR CITIES

Target Markets Demonstrating Outsized Return and

Growth Potential

Why 18-hour cities?

Over the last decade, real estate acquisition activity in the United States has been primarily concentrated on major “gateway” cities including Boston, Chicago, Los Angeles, New York, San Francisco and Washington D.C. Less capital has been focused on the high-growth 18-hour cities that Clarity targets. These cities have become increasing favored by businesses and individuals for their high quality of life, vibrant amenity bases and more affordable cost of living and doing business. Urban Land Institute (ULI), in their 2019 Emerging Trends in Real Estate report, identifies these 18-hour cities as attractive investment markets and featured 18-hour cities as nine of the top ten cities for overall real estate prospects.

Common traits:

- Strong economic fundamentals and demographics

- Growing population trends

- Diverse employment base with national and international employers

- Low-cost center for businesses to operate

- Strong and stable demand generators such as state capitals or university proximity

- Better year-round climate

- Live, work, play environments attractive to millennials

Office, multifamily and special opportunity investment